Upaddington

” It was one of those periods of ecstatic turmoil in the financial world, but for a short while everything seemed possible, miracles became commonplace, outcasts were left behind, and walking weak. …” Connie Brook, author of The Predator’s Ball.

It’s been nearly five years since the U.S. Supreme Court overturned the PASPA Act and launched the explosive growth of legal sports betting in the country. His next five years were akin to the gold strikes in the Yukon Territory of the 1840s. Just like back then, it’s bustling with adventurers from all over the world. They are all racing to win customers with overheated promotional giveaways. Fortunately for investors, however, the rate of marketing spending is starting to slow, benefiting the future of the sector as a whole. It’s time to stay long on the sector’s top picks:

flutter entertainment plc (OTCPK:PDYPY), OTC traded in the US.

Many investors have been left with failed dreams of getting rich quick after hearing some analysts predict a $200 billion market by 2025. Other true believers held out and were killed. DraftKings, Inc. (DKNG) shares have surged to $72 in 2021 and have since dipped below $14.

Some true believers held out but softened their positions. Among them, Kathy Woods’ Ark Investment Management left him the second largest position among DKNG’s institutional investors after selling her 368,418 shares in the third quarter of 2022. Other top holders are Vanguard and Black Rock, both of whom hold his DKNG positions at the time of this writing.

I cite DKNG because it’s pure play among the leaders and not units of parent casinos such as BetMGM (MGM) or Caesars Sports Book (CZR), both of which are top-notch operators.

An inevitable culling positions the sector to enter Phase 2 this year, when sheep and goats split and promotional spending falls like crazy. The battle for market share in new and mature markets has evolved, with four leaders controlling about 65% of his total monthly revenue, with all others chasing leftovers. are fighting

Google

Top: Long range, all north arrows for Flutter.

New York, New Jersey and Pennsylvania are among the largest kahunas in the country so far. (Despite its insane 51% tax rate on online games, New York State records a better-than-average tax rate.)

Since May 2018, three large states have acquired impressive handles.

- Pennsylvania: $18.1 billion handle wins $1.4 billion hold at 7.8%

- New Jersey: Wins $2.2b on $32.6b handle and holds 7%.

- New York: $15 billion handle, $1.2 billion win, 8.4% stake.

(Note: New Jersey, an early entrant into the sports betting fray, shows how time plays a role in holds. Over the years statistics show that the expected normal has a hold of 7%, which is a long-term forecast and is most often used to value equity companies in sector earnings forecasts.)

Nevertheless, the industry’s Phase 1 (2018 to YTD date) aggregates are an impressive topline for investors.

A cumulative total of almost three years of activity is:

Total handle $181.4b

Total wins: $13.7 billion.

Ownership rate 7.6%. So we can see that all 28 states are running, and 2 more states are about to start. Hold rates are heading towards the mathematically proven long-term edge that was built into odds-making systems decades ago.

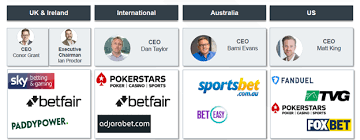

Phase 2: Pick your winner and go long, get a good night’s sleep and wait for a solid return. We limit our best bets to Tier 1 platform stocks due to their disproportionate share of the overall market. Scale is everything in this fieldTier 2 and 3 sports betting stocks dominate the space, but the 10 companies that dominate those tiers are all single-digit market share companies and are likely to see significant consolidation in the next five years. There is a possibility that it will be Below: Flutter’s multiple platforms include the best performing brands in this space.

flutter archive

Sports betting has benefited from the 2020 pandemic. People stuck in their homes. Now, as we enter the early post-pandemic era and could face a recession, the key to the kingdom is betting on scale.

invader: Investors should be aware that there are things peeking around the corner that could disrupt the market. First, Fanatics, his privately held online marketing for team apparel, has announced its entry into sports betting, and by the second quarter of 2023 he could be a SPAC entry. Second, it’s a real funny joker – ESPN is based on the assumption that Disney will wake up from a long snooze and give the network a sale sign, but it’s not quite clear yet.

If that happens, expect ESPN to decide to buy one of the second-tier operators or go it alone. Activist Nelson Peltz’s sudden incursion into Disney (DIS) prompted Robert Iger to abandon his earlier statement (and that of his interim successor, Bob Chapek) Hamada, Hamada, Hamada. , putting pressure on ESPN to sell will likely increase this possibility.

Either way, both of these entries can break. However, they are both very late to the party and will likely buy one of the medium sized operators to recast on ESPNBETS. None of these developments are likely to hurt select stocks in the sector, as they aren’t far from the biggest move to spin off FanDuel.

OUR CHOICE: FLUTTER ENTERTAINMENT – USA DEAL

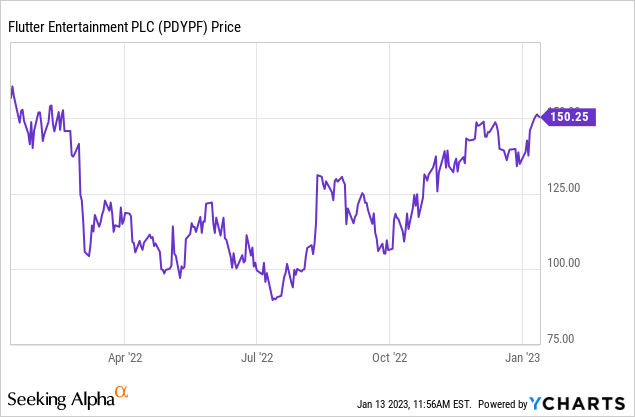

Price at time of writing: $150.10

52-week range: $88,30–$163,48

Market Cap: $26.4b

All-time high: 4/21 $205.11

PT: Until 2Q23: $183.50

Forward PER: 29.07.

Parent company FLTR has returned 41% over the past five years. Revenue in that period increased by 33% year over year. Strong revenue growth will continue on the back of FanDuel’s amazing US performance.

Total TSR over the last 5 years was 7%

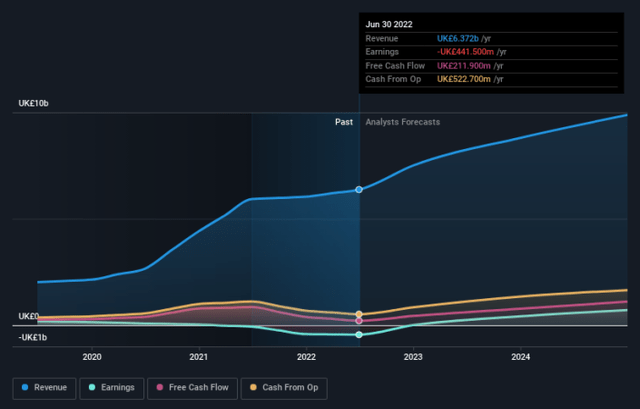

Based in the UK/Ireland, Flutter Entertainment is the world’s largest online and live sports betting and iGaming platform, generating over US$6.3 billion in revenue worldwide. Earnings in 2022.

In Q2 2022, FD posted its first quarterly profit, recording US$22 million for the period. Forecasts for fiscal 2022 show losses narrowing to ($300 million). Having put its 2023 company forecasts to its own test, we believe Flutter US will show full-year profits in the US, while most competitors will continue to post net losses through mid-2024, even as they cut promotional costs. may be maintained.

One of the fundamental reasons PDYPY stock is long is the inevitable spin-off of US market leader FanDuel. That’s variously valued between $11 billion and his $15 billion, according to various calculations, about half the current market capitalization of its parent company. Another is our global strength.

Market share United States

Companies’ claims of market share by state vary widely. Sometimes, within a month, one platform beats another in betting him in the mid-single digits, and vice versa. Promotional deals play a role. Overall, FanDuel is definitely the industry leading platform with a realistic market share of between 37% and 42% overall. DraftKings has him second nationally with a range of 22% to 29%.

The next two are casino operators. BetMGM, which owns 50% of him and UK-based betting giant Entain, continues to want his acquisition of Entain. (We think it’s very likely this year.) Fourth is Caesars Sports Book, which is very strong in the big Kahuna state. The two companies have an overall market share of about 15%. This leaves his single-digit share of the rest likely to grow overall with the size of the market, yet relatively he still holds a single-digit share.

Flutter gives you “unpaid” bonuses, the ultimate FanDuel spin-off. This would be the largest pure play in his betting on US sports, with the record holder receiving a premium in the process. one point or another. As such, a long tenure with Flutter provides a track record of performance by a global leader in sports betting, a dominant share in the fast-growing US market, his leader, and a reassuring parent company for owners.

Market by 2026

Google

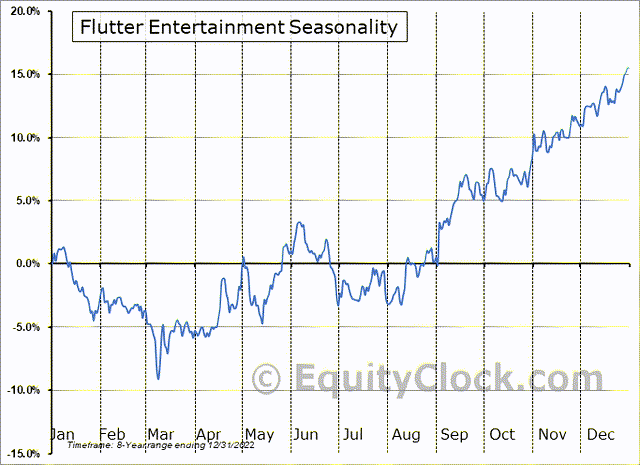

Above: FanDuel is entering its most profitable quarter of the season, largely due to increased interest in the NFL playoffs, Super Bowl, and NBA.

We have diligently followed the pace of legalization, revenue streams, market share, and platform improvements by the leaders since legalization. Looking ahead, he predicts that by 2025/6 the market will be between $25 billion and $33 billion. JP Morgan also came close to this assessment. One of the difficulties in predicting sports betting earnings projections is the continuing uncertainty about states that have not yet legalized but may do so by 2025.

Ohio and Massachusetts are two gems because of their demonstrations and presence in both professional and college sports. There are six professional sports teams, the monster Ohio State College football team, and 40 Division 1 college teams. Fan enthusiasm is high and betting volumes should follow. Massachusetts has four professional teams, most notably the Reds. He has fan enthusiasm for the Sox and Patriots, and while the campuses are plentiful, the college betting scene is less enthusiastic.

Our operational assumption here is that big guys like California and Texas are totally unpredictable and we don’t yet have a handleable market forecast.

I dug deep into statewide demographics to find the largest number of people with strong generational sports betting profiles and came up with an addressable market of up to 40 million real regular bettors.

On that basis, I am currently raising my original projection for total game wins by 2026 to $50 billion. Assuming existing market share remains stable, i.e. up and down by a few points, a realistic forecast for 2026 FD revenues with a 30% share is that the $15 billion business will I think you’re going to throw away $7.2 billion of gross margin. .

EBITDA figures cannot be realistically predicted. Because we’re dealing with an inherently low-margin business whose success or failure depends on cost efficiency, capital investment needs, and the skill set of the executive team in the trenches of future technology. So far, we believe this is a strong suit for Flutter, given its success so far in the US as well as its equally strong performance globally. Of course, what remains a problem for parents is the imminent impact of the new UK Gaming Regulation, which will significantly loosen gaming maximums and other restrictions to curb the prevalence of problem gambling.

Conclusion

Industry leadership is always important as it reveals to a large extent the differences in management skill sets among peers. All peers in long-lived sectors bring operational excellence to the business, but some will always be more agile, more creative, and more forward-thinking than others. At this point, we believe that, by all accounts, US-traded Flutter shares (essentially FanDuel) promise investors the best possible returns among all their peers. We are stable in second place, but we need to strengthen cost control more than ever.

This is not a wrap of the other two top tier platforms. But while sports betting, both live and primarily online, represents excellent sales growth opportunities for both MGM and CZR, their bread and butter has always been their brick-and-mortar casino business. Now, with the early post-pandemic days just around the corner and Las Vegas heating up every weekend, both are in a roar.

But in our view, Flutter Entertainment plc, even at its high price, represents a rock as sure as you can bet on the stock with the brightest future in sports betting over the next five years. .

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.